Interested in saving money? Whilst many of us have got extra time on our hands at the moment – and possibly also less income – it’s a great time for a money audit. Let’s reboot!

Whether you’re paying subscriptions for things you never use, buying food at all the wrong places, or have a house full of stuff you don’t need, it’s time to have a good look through everything and see where you can make tweaks that all add up to something substantial.

Audit time!

When was the last time you actually sat down with a few months’ bank statements and had a really good look at what you spend your money on? Maybe you’re one of those people who do this regularly, but we’re willing to bet there’s a lot more of you reading this who haven’t done a proper check for yonks.

We’ll get to things like the gym subscription later, but for now, look at your spending. Are you buying things and not using them? Time to Marie Kondo your finances. Declutter and clear up things you don’t need.

Comparison websites

When you’re going through your audit, open up a few comparison websites and really look at your bills. How are you doing with the utilities? Could your insurance policies be better value? What about things like phone contracts, broadband providers, pet coverage… time to start comparing! It’s a fast way to save money.

Save on supermarket shopping

Okay, so right now it’s not exactly a ‘normal’ shopping experience. Like most people, you’re probably doing a mixture of local stores, supermarket orders or shopping, and online purchasing. And grabbing things whilst you can. So it’s even harder to be clear about getting the best prices.

But spending a bit of time actually looking at this will pay dividends. And things aren’t likely to change much in the near future, so invest in this.

If you’re using local shops, for example, you’ll most likely find that some of the products are more expensive than the supermarkets. Equally, the greengrocers is far likely to be cheaper than Waitrose.

Instead of leaving it until you need something and being reactive, put a bit of structure in place. Spend a bit of time looking at what you need to buy and where is best to get it from. Then when you run out of eggs or bread, you’ll know where to find the cheapest prices.

Takeaways

We’re going to surprise you here and say that this may not be one of your baddies on the list. Actually, going for the JustEat or Deliveroo option might be better value than it appears.

We really don’t want to be the ones to take away (geddit) any luxury that you can actually enjoy during lockdown. And frankly, having someone else make you food and deliver it to your door is still a treat we all love.

If you’re buying unusual ingredients for things like Indian or Thai food that you don’t have in the cupboard, the chances are you might not use them again, which is a waste. And if you’re giving up your time to cook food, you need to look at what your time is worth. If you’re supposed to be working at home but instead learning how to make a totally new marinade or something, you’re not getting the best value from your time.

We’re not suggesting you do it every night, but the occasional treat delivered to your door is probably less of a ‘cost’ that it appears. Just don’t order more than you actually need!

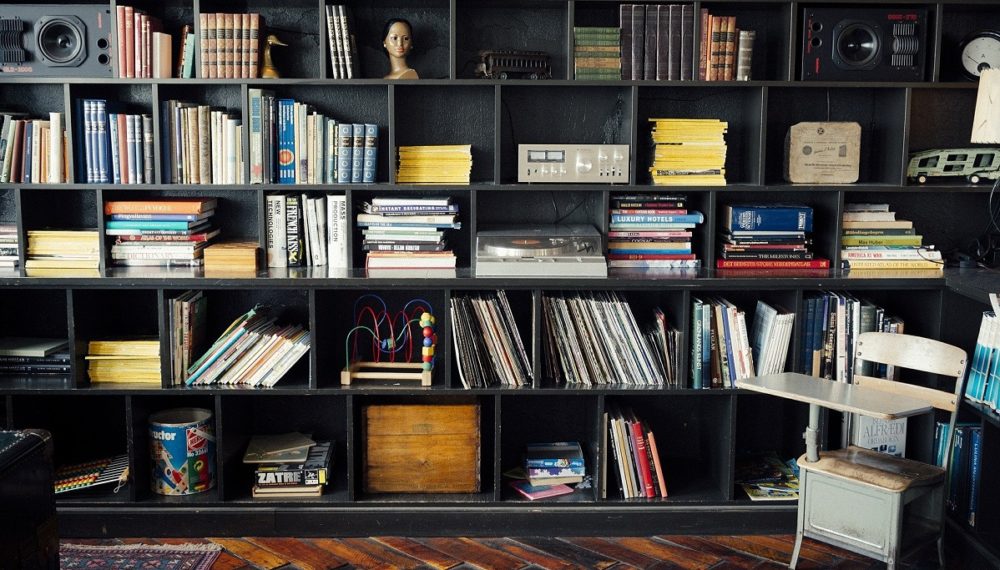

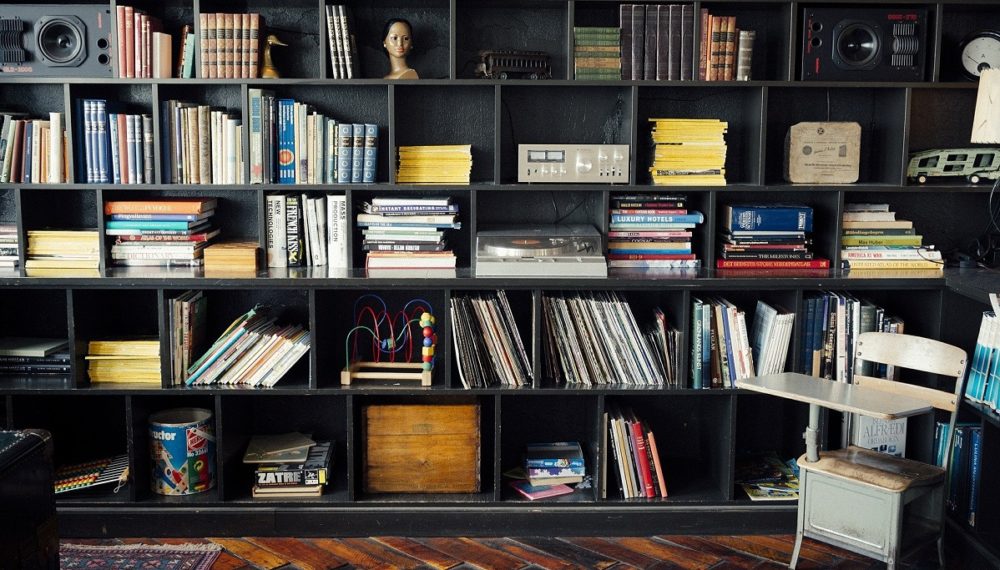

Declutter, create, and sell online

Also, those long days whilst you’re furloughed, or you’re struggling with creative frustration, stuck indoors for yet another night? Make stuff! Can you knit, crochet, paint? Turn your hand to something creative – and maybe it’ll be someone else’s little dream purchase.

The post office counters are still open, so you can flog stuff on platforms like EBay, Etsy and Facebook marketplace. Get rid of stuff you don’t need, make nice things to sell, and get a few pennies in your pocket.

Subscriptions and Direct Debits

This is likely to come up when you do your audit and actually look at your bank statements, as recommended in the first pointer. But you’d be amazed how many people have subscriptions and direct debits for things they don’t use or need.

As well as gyms (be realistic – if you’re not using the gym, don’t pay for it, go for a walk instead) there’s plenty that slip through the net. Free apps you’ve downloaded that have an automatic subscription collection after 12 months that you didn’t realise, for example.

What about insurance premiums for things you no longer have, the magazine you never read, the diet programme you don’t follow? Be ruthless.

Working from home

Assuming you’re still working… if you’re furloughed – unless your work contract states otherwise – you can actually do work for other companies, or yourself. Which means you could turn your hand to something like blogging as a freelancer. Or even work another job.

Check your contract carefully before leaping into anything – but supermarkets are crying out for helpers, drivers are in high demand. Maybe you can pick up some work?

Alternatively, use the time to learn something new – can you do courses, learn to code? Learn to do social media management? Life is going to be tough after lockdown eases, and it seems likely there will be a recession. Put yourself ahead of the game with sparkling new talents.

Add comment